Energy. Opportunities on the path to a zero-emission generation.

Businesses across the entire energy value chain are facing the complex task of transitioning to a climate-neutral energy system.

Ongoing digitalization and the shift toward decentralized, renewable energy generation are adding new layers of complexity to energy supply systems. Therefore all levels are affected, from investment and project planning and control, operation and security of supply, to the associated dismantling of old fossil and nuclear plants.

Our expertise. An excerpt from our services.

We bring many years of experience in supporting energy companies, from strategic issues to operational optimization.

Efficient plant utilization. Smart asset management in the energy industry.

Businesses in the energy industry face new challenges regarding the management of their plants. The construction and operation of comparatively small, decentralized power plant units require a new approach to asset management from energy suppliers, compared to large power plant blocks. The construction of HVDC transmission systems and intelligent grid control (keyword Smart Grid) require rethinking and high investments for transmission and distribution network operators. In addition, the dismantling of power plant units must also be managed efficiently and with controlled risk.

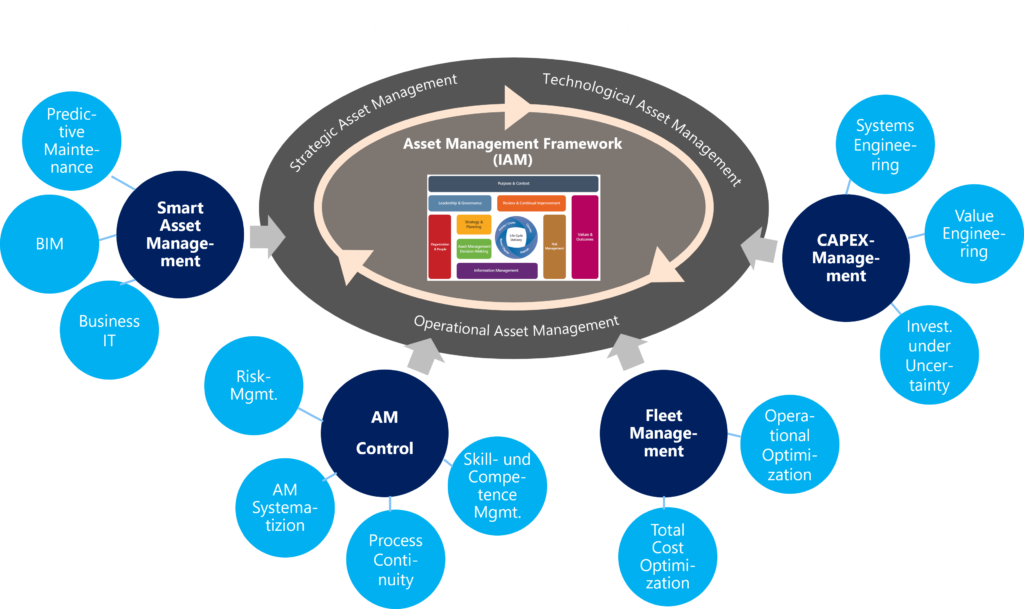

Selected topics in asset management that preoccupy decision-makers in the energy industry.

Professional CAPEX management represents a significant lever for the efficient use of capital employed and the reduction of uncertainty in investment decisions. It is particularly important with regard to the long planning and utilization period of plants in the energy industry and uncertainty regarding technological innovation and future legislation.

When used correctly, CAPEX management creates long-term benefits through investment in long-lasting assets and is a prerequisite for securing future growth and further development of companies. The focus for maintenance and compliance projects is usually on the efficiency of the investment, while the effectiveness is in the foreground for expansion projects.

The importance of CAPEX management can be clearly seen in the following characteristics of energy suppliers. On the one hand, investments in the industry account for a high proportion of the absolute amount of total costs and entail significant follow-up costs (e.g. for maintenance). Furthermore, investments made are usually difficult to reverse. Finally, the plant investments, as central enablers and disablers of economic development, have a prominent position in the corporate strategy.

Over the years, a large selection of tools has been developed, which are available to businesses in the energy industry. Structured CAPEX management deals with the entire project process, with appropriate methods for each project phase. In the first planning phase, systems engineering and requirements management can be mentioned as examples. Further approaches are available in the following phases (e.g. value engineering, LCC optimization, sourcing and supplier management). Further tools have been developed for the project planning and construction phases (e.g. unit cost consideration, planned cost stability approach).

Successful companies allow the respective process users a certain amount of freedom in the implementation of the above-mentioned tools. However, the planning and tools used should be centrally developed and recorded before the start of the project. This creates the need for plant owners and managers to be familiar with the advantages and disadvantages of the individual approaches and to be confident in their application.

Smart asset management is a key component for the successful construction and operation of large infrastructure projects (e.g., HVDC lines on the north-south routes), as well as intelligent distribution networks and decentralized power plant units. This is based on digital solutions such as Building Information Modeling (BIM) or Predictive Maintenance, which are supported by consistent process control. This effectively addresses the increasing complexity in the construction, operation, and maintenance of the plants.

At the heart of BIM is a digital twin, which serves as a central overview and coordination point for all internal and external parties involved – from the beginning of the planning phase through execution and operation to dismantling. Using the model, all stakeholders can access the current status of construction progress, plant condition, and any disruptions that occur. Tasks can be assigned and collaboratively processed, and the processing status and completion can be verified. The primary challenge here is the technical infrastructure and usage knowledge of all participants, including comparatively small companies. Ideally, a single model exists (open BIM) – however, various versions can also be regularly merged (closed BIM). In any case, the same basic model is always the foundation.

In addition to a common reference model, the consistency of asset management plays a crucial role. On the one hand, attention should be paid to a clear end-to-end definition of the processes, mapped on one and supported by suitable tools for control. In addition, the flow of information between and across the management levels should be ensured. Professional data management based on uniform data formats and structures is a prerequisite for this.

In our experience, energy companies must overcome a number of challenges to be able to exploit the full potential of Smart Asset Management. Possible topics range from the requirements for the database and IT landscape to changed planning processes and an adaptation of role models and corporate culture.

The change in energy generation forces suppliers to deal with the dismantling of plants, taking into account the life cycles. The problem comes to light that the experience with dismantling projects prevailing in the organization is usually low and, due to the individuality of the plants, few reference projects exist in the market. Each dismantling must therefore be assessed and planned as an individual case.

Plant owners must also prepare themselves for risks in the technical controllability of the dismantling process and in accompanying approval procedures. Even if a possible residual risk cannot be completely ruled out, these can at least be minimized through consistent risk management, in particular with regard to possible, unplanned costs. Attention should be paid to active risk management and implementation within all affected levels of the organization. The target is to reach the optimal ratio between the scope and associated costs of the measure, and the benefits of the measures to reduce risk.

Active risk management is based on comparing the ratio of target and actual risks for each individual project. The maximum tolerable target risks can be determined with the help of a Value at Risk calculation (Value at Risk as, which includes in particular the costs but also legal consequences in the event of the risk occurring. This is compared with a current analysis of the actual risks, which result from the probability of occurrence and the financial impact. If the target risks are exceeded by the actual risks, countermeasures must be taken, which are ideally defined before the start of the project. A review of target and actual risk should take place regularly (e.g. quarterly) in order to include the latest developments.

In addition, risk management must be implemented in all affected levels and processes of the organization. A three-stage model is recommended, which includes the structured recording of the actual situation, the concrete adjustments in the dimensions of processes, organization and employees, as well as the implementation of the identified measures. In our experience, the involvement of an external partner in the development of concrete measures is helpful in order to gain a second look at the necessary adaptation of established processes and structures.

Large-scale projects in the area of energy and supply infrastructure – such as grid expansion, power plant dismantling, or comprehensive modernization and renovation measures – are characterized by high investment volumes, complex approval procedures, and a large number of stakeholders. Without professional project management, they involve significant risks in terms of schedule overruns, cost increases, and quality losses.

Integrated large-scale project management creates the necessary transparency and control capability here. The focus is on project governance and PMO structures, consistent schedule, cost, and quality management, as well as continuous cost, performance, and progress measurement. Supplemented by professional reporting, reliable decision-making bases are created for control and escalation. Equally crucial are forward-looking risk management and the active involvement of stakeholders to reliably meet regulatory requirements.

Large-scale project management gains particular importance through its life cycle-oriented perspective: project results are designed from the outset so that they can be seamlessly integrated into operation and asset management processes. This not only increases the implementation security of infrastructure measures, but also makes a sustainable contribution to the security of supply and value creation of the asset portfolio.

Fontin & Company. Topic!

Background information and analyses on current topics: The Fontin & Company Thema! reports.

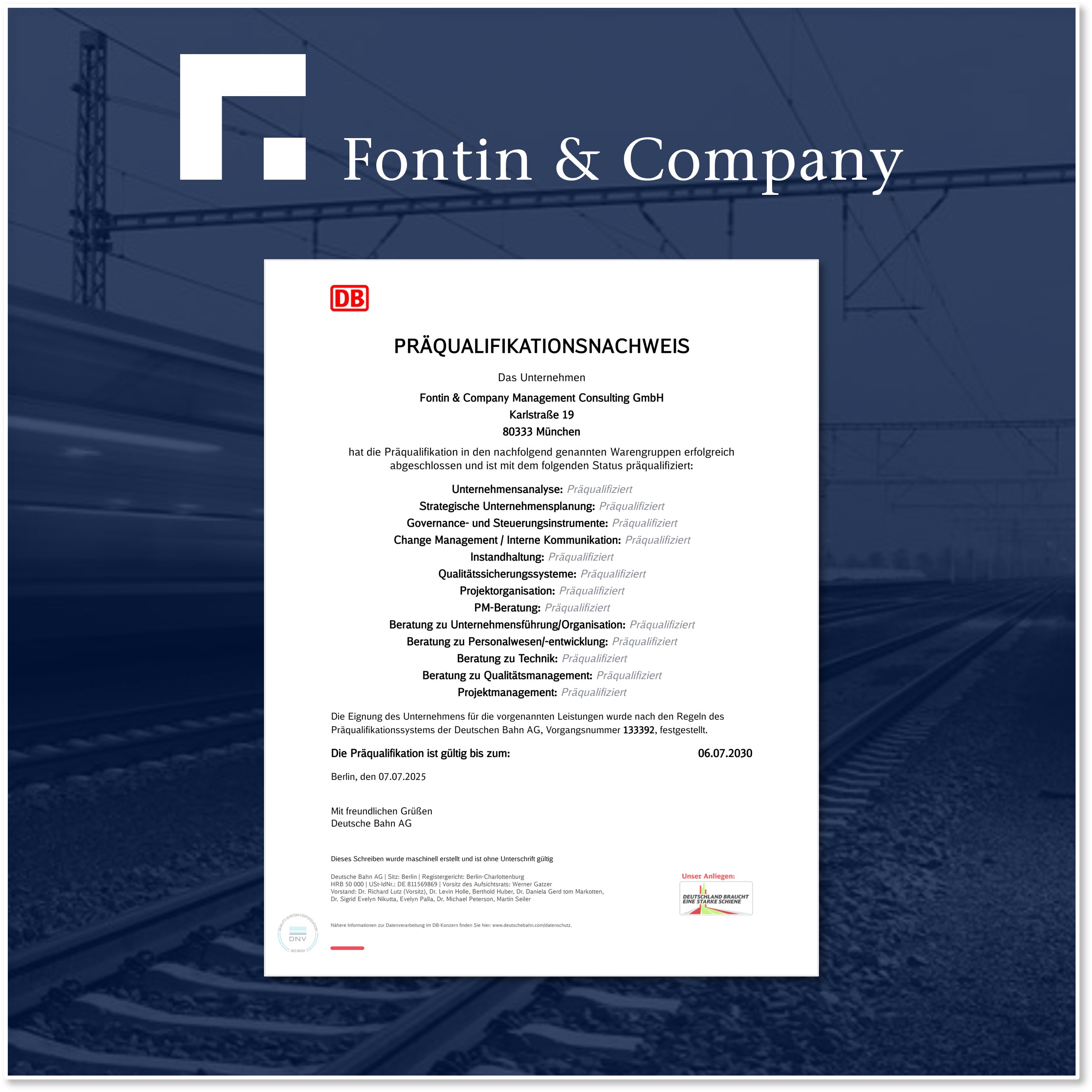

F&C in Consultingresearch column: Opportunities for changes in the energy industry